Portfolio (Collated)

Portfolio Update 2 - 2nd December 2024

Portfolio Changes

0. Ideology

Figures below are weighted averages and I expect them to improve in the future.

- High returns on capital: 15.87%

- High insider ownership: 28.76%

- High revenue growth (3Y CAGR): 35.76%

- High free cash flow growth (3Y CAGR): 25.95%

- Healthy balance sheet

- In a down-cycle

- Largely founder-led

- Promising tailwinds

1. Alibaba (Closed)

Alibaba was the first stock that I truly had conviction in since I started learning about investing in 2021. I felt that the risk-reward trade-off was overwhelmingly skewed in my favour, and this seemed to be a, as Mohnish Pabrai would say, “Heads I win, tails I don’t lose much” kind of situation. I didn’t manage to see the weakness of the Chinese market over the past few years that had hurt Alibaba’s top line. I also failed to notice that the government crackdown and the resulting reduced combativeness of Chinese companies made Alibaba lose several competitive advantages to its smaller competitors (i.e., Pinduoduo).

In the recent few months, with the hope of a large stimulus package in China, I increased my allocation in hopes for a short term bet. If a large, direct-to-consumer form of stimulus package were to come, Alibaba will be amongst the first to benefit. Egged on by the media and the typical social media echo chamber, I became more of a speculative trader than an investor for this position. Against my wishes, the Chinese government decided to focus more on alleviating local government’s debts first instead of a quick stimulus package.

I felt that this was a step in the right direction. They opted for a more controlled, sustainable stimulus than a short term “policy bazooka” which would’ve been good for my shares but bad for the country in the long-term. I also believe that the new management of Alibaba has been taking the right steps to restructure the company to be more focused and profitable. The steps that they have been taking in Alibaba Cloud, International Commerce, and Generative AI are all steps in the right direction.

It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.

— George Soros

However, I have still decided to close my position in Alibaba (I might regret this). I felt that with the government pushing for “common prosperity” and a slow recovery of the Chinese economy, Alibaba’s woes are far from over. They have to now fight much harder for the same pie, providing huge discounts to consumers in hopes of convincing them over to their platform. This will hurt their bottom line and the returns on investment remains unclear. At the moment, I see other opportunities which will provide a greater risk-reward trade-off and has hence shifted the capital from Alibaba to these other opportunities. I will continue to keep this company under close watch and add a position when I see a recovery in business fundamentals. I like the new management and hope that they succeed in turning around the company.

2. 10% Other (Speculative) Bets

The microcaps are where many of the best investors made their first fortune. This is a space filled with dramatic victories and catastrophic failures that are too small for many institutional investors to invest in. That means retail investors are well-positioned to find a rocket that’s just about to take-off and latch on to it firmly. One of the best microcap investors I know is Ian Cassel, and his site has many nuggets of wisdom that everyone can benefit from. Investing in this space is tricky — you can use basic screeners to filter for profitable microcaps but there’s much less information in them relative to the larger companies.

Consequently, one has to invest much more effort to study the same company, why it’s opportunities exists, what catalysts are there, how the management is like, and how does the future look. After all, investing is more of studying history and predicting the future. Unfortunately with less of a track record for the company, most predictions are going to be off. I’m also unable to go down to the ground to check out the company’s operations, so I have to rely on the management’s words, the company’s financials, and writeups written by others to understand a company. I plan to look into each of these in greater detail, but here are some quick thoughts on each of them:

- California Nanotechnologies: Have you heard of transparent aluminium? They are the only company that does what they do in the United States, they have contracts with big companies like NASA, they make materials for the cutting-edge, and they’re just getting ready to scale up operations with new equipment and facilities opened. [Very interesting writeup by Whiteout Capital].

- Kraken Robotics: They have industry-leading underwater sonar technology, and they manufacture subsea batteries that can go far deeper than its competitors. Potential government contracts coming up due to an increased focus on building autonomous underwater vehicles. [Another nice writeup by Whiteout Capital] [Deep Sail Capital also has a intriguing writeup on them]

- NTG Clarity Networks: Provides customised software solutions for client, growing revenues and profits in triple digits, yet avoided by investors due to conflicts in the Middle East and high concentration in key client.

- TSS, Inc: Small cap sitting on the AI tailwind, designs, deploys and maintain data centers and other IT infrastructure. AI is powered by data centers.

I look forward to learning more about them and developing greater convinction (or not) in them. I expect to write a collated summary of my learnings on each of them in the near future. For now, these will occupy a very small position in my portfolio. Just like how Amazon had many small bets that failed, some eventually turned out spectacularly well (i.e., AWS, Kindle) and paid for the failed bets many times over.

Heads I win, tails I don’t lose much.

3. Cash is a position too

A soldier fighting a gunfight will not exhaust all his bullets on the first few enemies he sees. He will conserve his bullets and use them only when he sees a clear opportunity to win. Similarly, I will conserve my cash and use them only when I see a clear opportunity to win. I have a few companies that I’m watching closely (mostly those already in the portfolio) that I’m eager to add to once the valuation is right. 12.5% seemed like a right balance between trying to be fully invested and having sufficient gunpowder to take advantage of opportunities in this overvalued market. Also, having cash is like having an investment that grows at 0%, which is better than an investment that grows at -10%.

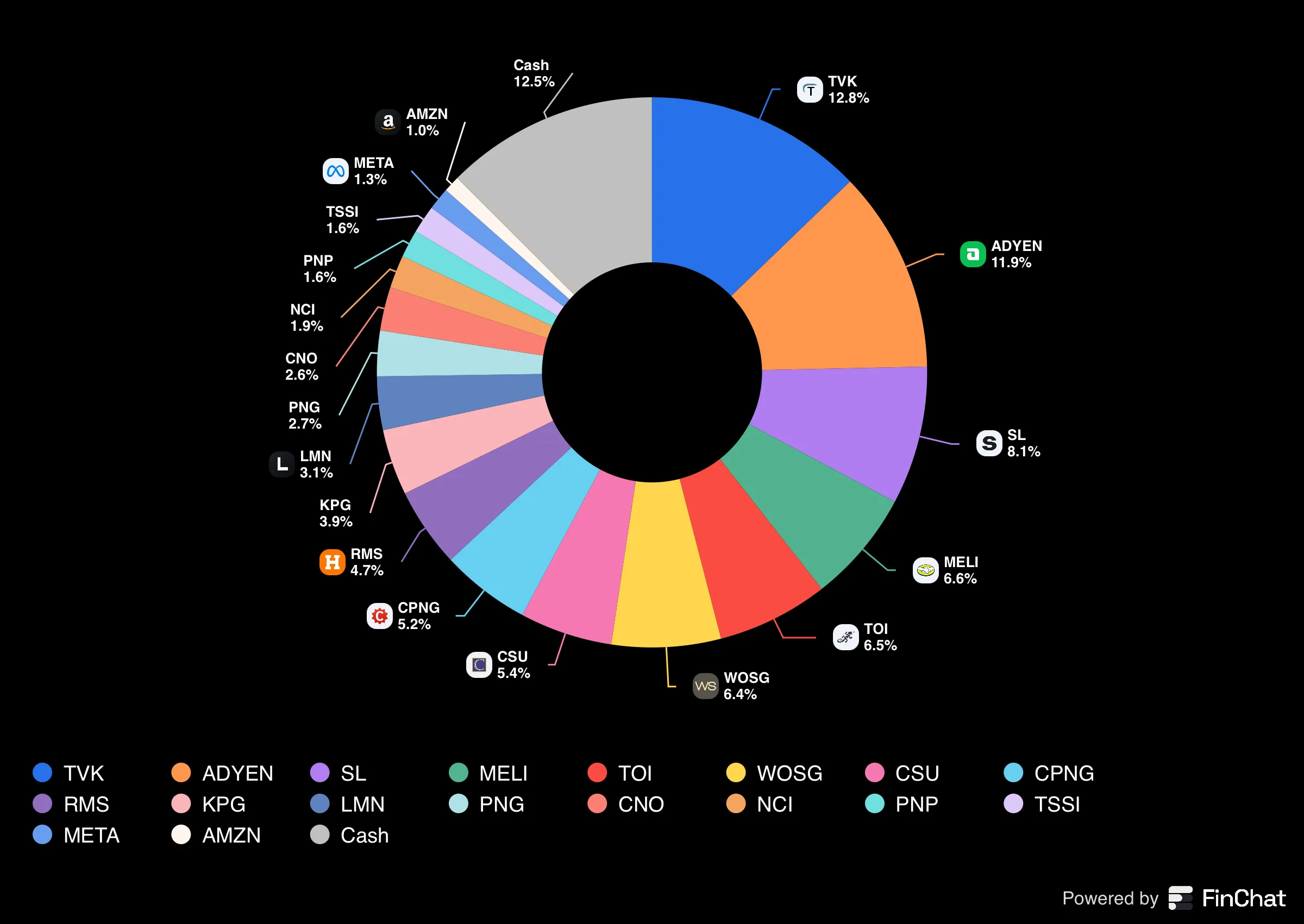

4. Main Bulk of the Portfolio

I’ve allocated the companies in accordance to my conviction in them (alongside some unrealised gains). I’ve also tried to diversify across sectors and geographies to reduce the risk of a single event affecting my portfolio. I’ve also reduced the number of large-cap companies in my portfolio, as I believe that the best returns are to be found in the smaller companies. I’ll be collating my thoughts on each company in the upcoming posts. This allocation include some gains that the companies have made since I recently bought them in IBKR and I’m perfectly fine with them growing beyond their initial allocation. I don’t see a point rebalancing my portfolio for the sake of it, plucking the flowers and watering the weeds. I’ll just let the winners run.

Some miscellaneous notes

In my previous portfolio update, my investments were distributed across multiple platforms, including IBKR, Moomoo, Webull, and FSMOne. This myriad of platforms diluted my focus and imposed superficial constraints on my ability to allocate capital rationally. I subconsciously had the impression that I had to fully allocate the capaital with what each platform allows me to buy, with the capital that’s already in the platform. This “sunk cost” meant an overall portfolio allocation that was skewed against maximisation of the risk/reward of my portfolio. Also, IBKR provided access to a broad range of European equities, Moomoo’s platform was comparatively restrictive in this regard. Eliminating these artificial barriers to investment opportunities was a pivotal step in improving my decision-making process.

One significant drawback I observed with Moomoo was its design, which seemed to foster a speculative, almost gambling-oriented mindset. The app’s interface resembled what one might expect of a casino platform, with frequent flashes of green and red, sensationalist “news” promoting impulsive trading, and a comment section filled with emotionally charged and unsubstantiated calls to “buy” or “sell.” Such features, while undoubtedly aligned with the brokerage’s incentive to drive trading volume and thus increase commissions, influenced me more negatively than I would’ve liked and did not align with my investment philosophy.

In contrast, IBKR presented a far more professional and less gamified platform, providing access to significantly greater global coverage. Consequently, I chose to consolidate my holdings within IBKR, closing my accounts with Moomoo, Webull, and FSMOne to streamline my portfolio and enhance my focus on long-term investment objectives.

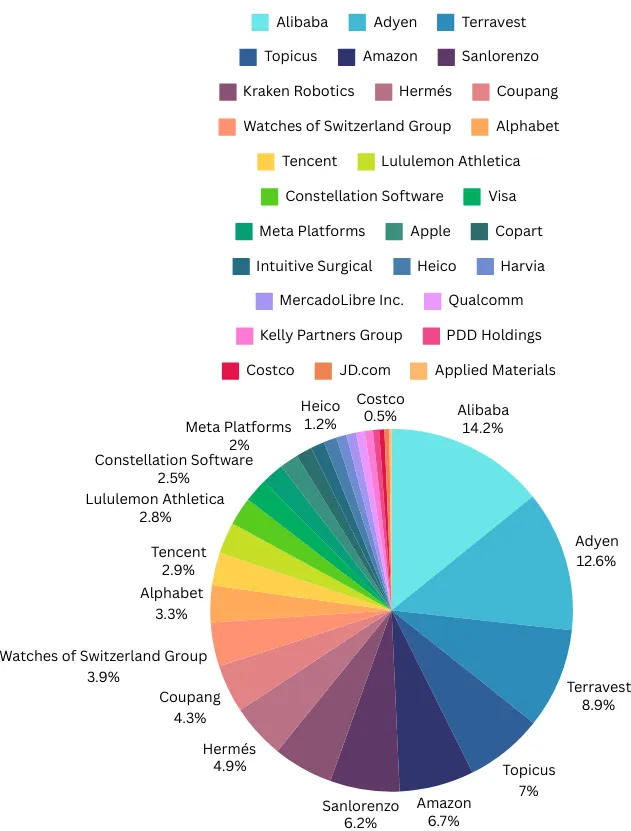

Portfolio Update 1 - 9th November 2024

I’ve realised that my approach to portfolio allocation has been less structured than it should be. I’ve been adding positions in a somewhat reactive manner—most backed by thorough research and some others cloned from investors whom I admire. Often, I add to stocks I perceive as undervalued without considering their existing weight within my portfolio or the broader impact on my portfolio’s internal rate of return. I’ve become somewhat of a hoarder.

This is not good.

Going forward, I need to adopt a more intentional strategy. Each addition should be assessed not only for the amount invested but for its impact on the overall risk-reward balance and its potential to meaningfully enhance portfolio value. This also means identifying and monitoring key performance metrics specific to each company, ensuring that I stay aligned with my long-term objectives. By regularly documenting these thoughts, I’ll be able to track allocation adjustments over time and gain insight into how my decisions influence the portfolio’s trajectory.

Additionally, I realize that I need to streamline my holdings. With 28 stocks, it’s worth questioning the value of holding my 28th best idea. My plan is to trim smaller, lower-conviction positions and increase exposure to high-conviction investments. I’m also considering setting a cap on the initial allocation to each position; while I’m comfortable with a stock’s value growing beyond its starting percentage allocation, limiting my initial exposure will help manage downside risk more effectively.

Some upcoming portfolio changes:

- I want to buy companies that are secular in nature, whose ability to do well lies largely in their control and not that of an external party (i.e. the government).

- I plan to greatly reduce the number of large-cap companies in my portfolio. Many of the best investors made their first fortunes in smaller sized companies where institutional investors couldn’t play.

A careful review of my portfolio is needed to ensure, in the upcoming changes, I do not “trim the flowers and water the weeds”.